By Orr Group‘s Steve Orr, Kelly Dunphy, and Katy Moore

The Coronavirus Aid, Relief, and Economic Security Act (CARES Act), the largest economic relief bill in U.S. history with an estimated $2.2 trillion price tag, was signed into law on March 27, 2020. The CARES Act includes several key relief elements that could prove essential for nonprofit organizations affected by the economic downturn.

Loans

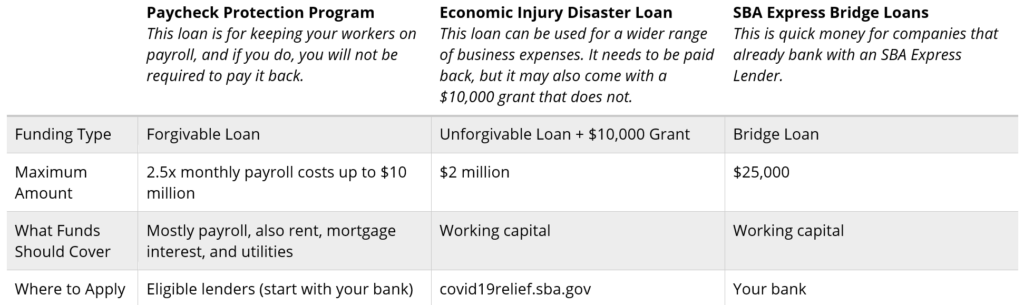

The CARES Act created or expanded two Small Business Administration loan programs relevant to nonprofit organizations.

The Paycheck Protection Program (PPP) provides small nonprofits – those with fewer than 500 employees – financial relief in the form of low-interest (1%), federally-backed loans of up to $10 million to help cover operational costs such as payroll, rent, health benefits, insurance premiums, and utilities. PPP loans have few borrower requirements, no collateral or personal guarantee is required, and, if certain criteria are met, loan amounts can be forgiven in whole or in part. We’ve linked the official PPP fact sheet here.

The Economic Injury Disaster Loan (EIDL) program is an existing Small Business Administration program that provides loans of up to $2M (actual loan amounts are based on the amount of economic injury) to assist small businesses and nonprofit organizations in declared disaster areas with operating expenses such as payroll, accounts payable, and payment of fixed debts. Interest rates are fixed at 2.75% with repayment terms up to 30 years. Unlike the PPP loans, EIDL loans are not forgivable but can be more flexible than PPP in the types of expenses covered.

The National Council of Nonprofits has developed a simple side-by-side comparison of the two loan programs to help organizations determine which program, if any, is right for your needs.

If your nonprofit is eligible for one of these loan programs, you should apply.* You can only receive one type of loan, so do your research and choose the program that’s best for your organization’s situation. Here are a few next steps that we recommend taking ASAP.

Applying for a PPP loan:

- Determine eligibility.

- Contact your bank. Only approved SBA-approved lenders can accept applications for PPP. While it’s likely that your existing bank or credit union is a qualified lender, you can search here to confirm. Since funds are available on a first-come-first-served basis, it’s important to submit your application as soon as possible.

- When in doubt, file. There’s no penalty for applying and the SBA is expected to take a broad approach to eligibility.

- Don’t delay! Congress and the Treasury Department have already concluded that the initial amount of $349 billion for the PPP is not enough. With bipartisan support, they are beginning to take steps to allocate additional funding to the program. However, we recommend applying as soon as possible to secure funds that have already been approved.

Applying for an EIDL:

Charitable Deduction Incentives

The CARES Act also provides incentives for charitable contributions. In 2017, the Tax Cuts and Jobs Act roughly doubled the standard deduction, dramatically reducing the number of individuals who could itemize their deductions and thus providing fewer tax incentives for individuals to make charitable donations.

The provisions of the CARES Act allow non-itemizers to deduct up to $300 in cash giving for the 2020 tax year, encouraging donors to support their favorite nonprofits organizations with small but essential gifts.

This also incentivizes taxpayers at higher incomes – those that do itemize – to increase their charitable giving by lifting the cap on annual giving, increasing it from 60% to 100% of adjusted gross income.

Many individual donors are unaware of these new charitable giving incentives. Nonprofits should consider communicating this information with donors and leveraging these new tax incentives to increase giving in this time of need.

Conclusion

Having a strong nonprofit sector is essential to our country’s social safety net. Nonprofit organizations are on the front lines of the COVID-19 crisis providing healthcare, food, shelter, and more. As your organization plans for the weeks and months ahead, make sure you understand and are accessing the many provisions of the CARES Act. This vital relief funding can help sustain your organization and your employees during and in the aftermath of this pandemic.

*Orr Group recommends contacting your financial or legal counsel to determine if applying for a loan is the best option for your organization.