By The Numbers: Small business representation across Greater Washington

Small business is important to the Board of Trade; we are one. And as a representative of Greater Washington, celebrating Small Business September this year allows us to show how important small businesses’ vitality is to our region’s ecosystem.

To lean in on small business awareness in our region, our policy team looked at data points around small businesses across D.C., Maryland, and Virginia and collected some important statistics showing small businesses’ financial struggles.

A huge need for small businesses is getting funding opportunities to create a vibrant and healthy small business community in Greater Washington. According to the U.S. Chamber of Commerce, in 2022, 69% of small businesses say that relied on personal savings to finance their business compared to 60% in 2020, which shows the need for funding opportunities for new small businesses looking to grow the U.S. economy.

The U.S. Chamber of Commerce also shared recently that small businesses in the United States are in much need of funding through capital investments, collecting data that shows 33% of businesses that launched in 2024 did so with less than $5,000 USD, with 58% of businesses launching in 2024 with less than $25,000 USD.

As mentioned, our policy team has gathered data from the Small Business Association’s Office of Advocacy that breaks down the percentage of small businesses in Greater Washington. This includes highlighting percentages of women and minorities that represent small businesses across D.C., Maryland, and Virginia.

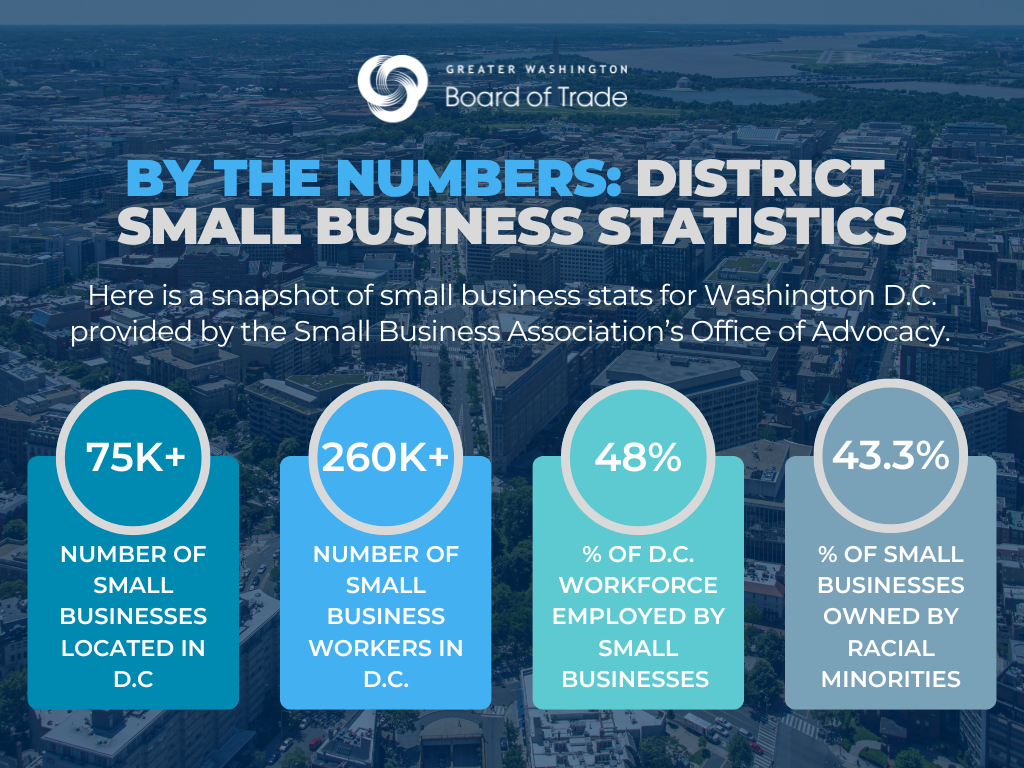

DISTRICT OF COLUMBIA

- There are 75,579 small businesses in DC, which make up 98.1 percent of all businesses in the District.

- DC’s small businesses employ 260,713 workers, which accounts for 48.0 percent of the total DC workforce.

- Women comprised 51.4 percent of the workforce and owned 47.4 percent of businesses. Veterans made up 3.0 percent of the workforce and owned 4.1 percent of businesses. Hispanics accounted for 11.0 percent of the workforce and owned 8.0 percent of businesses. Racial minorities made up 50.0 percent of the workforce and owned 43.3 percent of businesses.

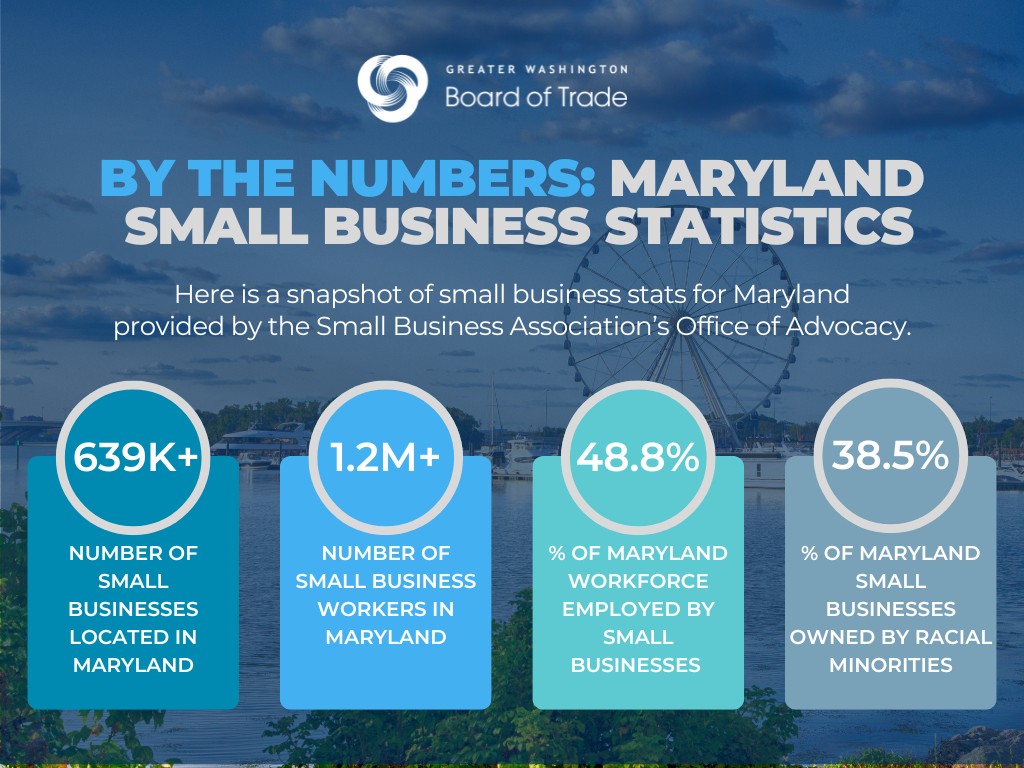

MARYLAND

- There are 639,789 small businesses in Maryland which make up 99.5 percent of Maryland businesses.

- Maryland’s small businesses employ 1.2 million people, which accounts for 48.8 percent of the state’s total employees.

- Women comprised 49.2 percent of the workforce and owned 44.6 percent of businesses. Veterans made up 5.7 percent of workers and owned 6.6 percent of businesses. Hispanics accounted for 9.8 percent of the workforce and owned 9.2 percent of businesses. Racial minorities constituted 43.7 percent of the workforce and owned 38.5 percent of businesses.

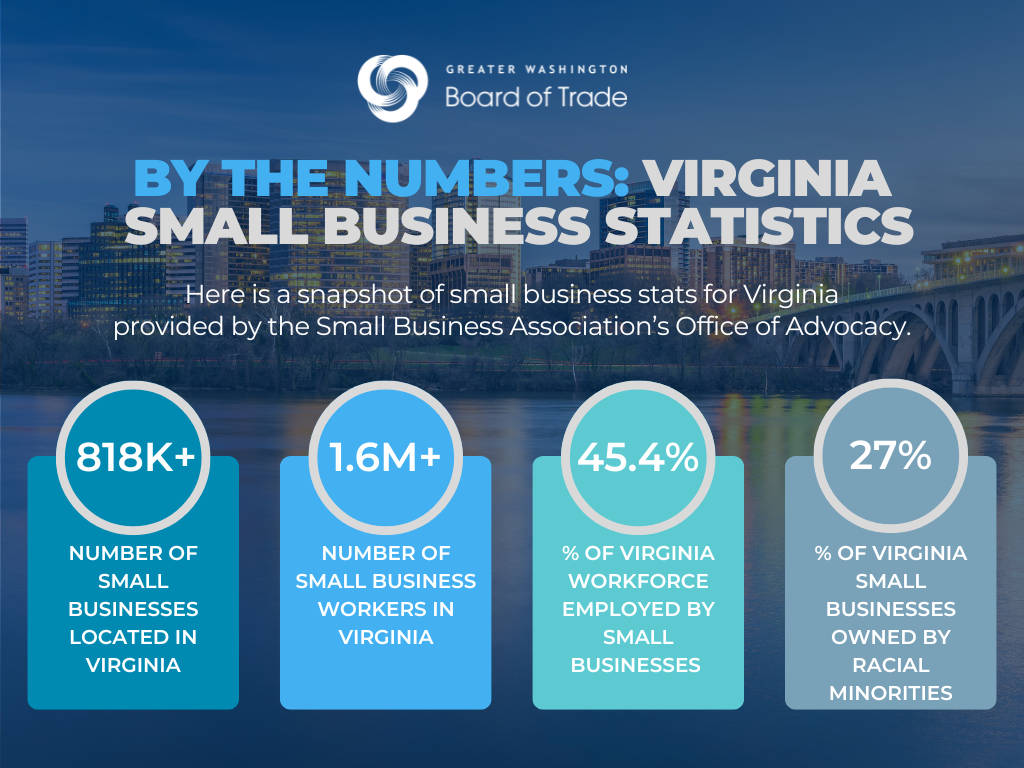

VIRGINIA

- There are 818,450 small businesses in Virginia, accounting for 99.5 percent of all businesses in the state.

- Small businesses in Virginia employ 1.6 million employees, which accounts for 45.4 percent of Virginia’s workforce.

- Women made up 47.6 percent of the workforce and owned 44.3 percent of businesses. Veterans comprised 8.6 percent of the workforce and owned 9.1 percent of businesses. Hispanics accounted for 9.5 percent of the workforce and owned 9.2 percent of businesses. Racial minorities made up 32.1 percent of the workforce and owned 27.0 percent of businesses.

The Board of Trade will continue to engage with people and business professionals in our region to help promote small business across the Greater Washington region. And the vitality and future of small businesses depends on public officials, regional stakeholders, and the broad Greater Washington business community, working together for a better future for our region.

There is a lot to learn about small businesses that the SBA and U.S. Chamber of Commerce shares so people can learn more about the opportunities and struggles small businesses face.

Below are a few stories you can read:

New Survey Shows Small Businesses Growing Concern about Raising Capital

U.S. Chamber of Commerce: Small Business Data Center

U.S. Small Business Administration: Fund Your Business

SBA: Women Entrepreneurs Are Accelerating the Small Business Boom

Become a member today

We need your voice at the table to make Greater Washington a place where everyone can succeed